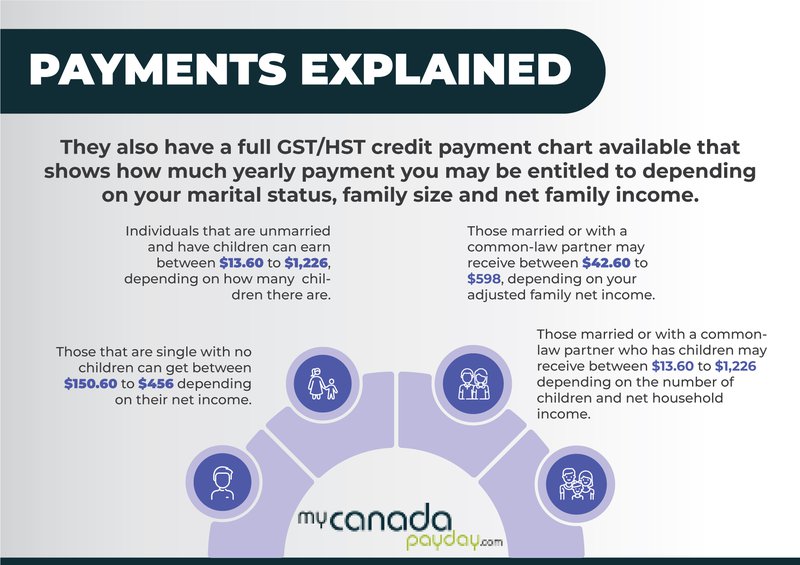

GST (Goods and Services Tax) and HST (Harmonized Sales Tax) are consumption taxes imposed in Canada on most goods and services sold or provided in the country.

Understanding how GST and HST payments work is crucial for businesses and individuals to comply with tax regulations.

In this article, we will discuss five important points to help you better understand GST and HST payments in Canada.

1. What is GST and HST?

GST is a 5% federal tax that applies to the supply of most goods and services in Canada.

HST, on the other hand, is a combined federal and provincial tax that applies in provinces that have harmonized their sales tax with the GST.

HST rates vary by province, ranging from 13% in Ontario to 15% in Nova Scotia.

2. Who needs to register for GST/HST?

Businesses with annual taxable supplies exceeding $30,000 are required to register for GST/HST.

However, some businesses may choose to voluntarily register even if they do not meet the threshold to claim input tax credits on their purchases.

3. Input tax credits (ITCs)

Registered businesses can claim ITCs to recover the GST/HST they paid on purchases related to their business activities.

This helps to avoid double taxation and reduces the overall tax burden on the business.

It is important to keep detailed records of all purchases to support ITC claims.

4. Filing GST/HST returns

Businesses must file their GST/HST returns either annually, quarterly, or monthly, depending on their level of taxable supplies.

Returns are typically due one month after the end of the reporting period.

Late or incorrect filing can result in penalties and interest charges.

5. Electronic filing and payment options

The Canada Revenue Agency (CRA) offers electronic filing and payment options for GST/HST returns to simplify the process for businesses.

This includes online portals where businesses can submit their returns, make payments, and track their tax accounts.

Electronic filing also reduces the risk of errors and delays associated with paper-based processes.

Other Stories You May Like

Conclusion

Understanding GST and HST payments in Canada is essential for businesses and individuals to comply with tax regulations and avoid penalties.

By knowing the basics of GST/HST, including registration requirements, ITCs, filing returns, and electronic payment options, you can ensure that your tax obligations are met in a timely and accurate manner.

If you have any questions or need further guidance on GST and HST payments, it is recommended to consult with a tax professional or the Canada Revenue Agency for assistance.