Introduction:

The age at which individuals can start receiving their pension in Australia is a topic of interest for many as it directly affects their retirement plans.

As of July 2024, there have been changes to the pension age along with adjustments to the amount and payment dates.

In this article, we will discuss the pension age in Australia, the amount individuals can expect to receive, and the payment dates to help individuals better plan for their retirement.

1. Pension Age:

As of July 2024, the pension age in Australia is set to increase to 67 years.

This means individuals will need to wait until they reach the age of 67 before they can start receiving their pension payments from the government.

The gradual increase in the pension age is due to improvements in life expectancy and the need to sustain the pension system for future generations.

2. Amount:

The amount individuals can expect to receive as part of their pension in Australia varies depending on factors such as income, assets, and whether they are single or in a couple.

As of July 2024, the maximum basic rate for a single person is $944.30 per fortnight, while for a couple (both eligible), it is $711.80 each.

There are also additional supplements and allowances available for those who qualify based on their circumstances.

3. Payment Dates:

Pension payments in Australia are made on a fortnightly basis, with payments typically made every two weeks into the recipient’s bank account.

The exact payment dates may vary depending on the individual’s circumstances and when they first lodged their claim for the pension.

It is important for individuals to keep track of their payment dates to ensure they have enough funds to cover their living expenses.

4. Eligibility:

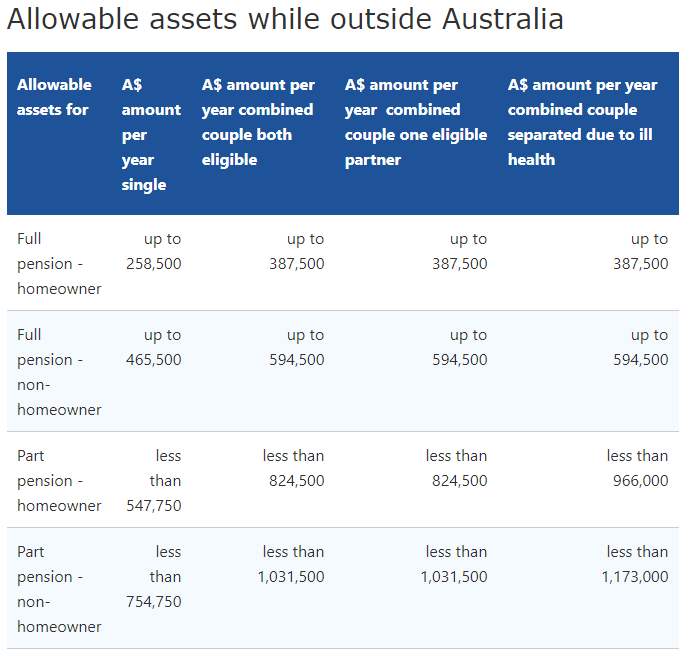

To qualify for the age pension in Australia, individuals must meet certain eligibility criteria, including being of pension age, meeting the residence requirements, and passing the income and assets test.

The income and assets test determines the amount of pension individuals are entitled to receive based on their financial situation.

It is essential for individuals to understand their eligibility for the pension to ensure they receive the correct amount.

5. Changes:

Over the years, there have been several changes to the pension age, amount, and payment dates in Australia to adapt to the evolving needs of the population and the economy.

It is important for individuals to stay informed about these changes and plan their retirement finances accordingly to ensure they can enjoy a comfortable retirement.

Conclusion:

As of July 2024, the pension age in Australia is set to increase to 67 years, with individuals eligible to receive varying amounts based on their income, assets, and circumstances.

Pension payments are made on a fortnightly basis, and individuals must meet certain eligibility criteria to qualify for the pension.

It is essential for individuals to understand the pension system in Australia and plan their retirement finances accordingly to secure their financial future.

By staying informed about the pension age, amount, and payment dates, individuals can make informed decisions about their retirement plans and enjoy a comfortable and stress-free retirement.